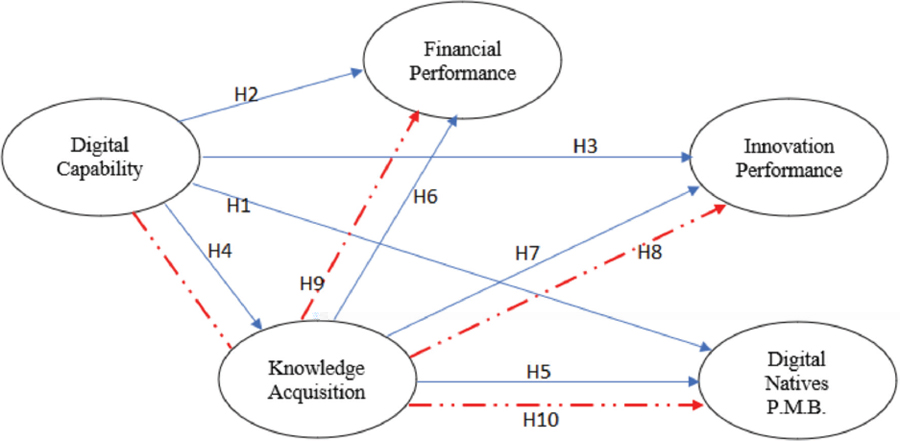

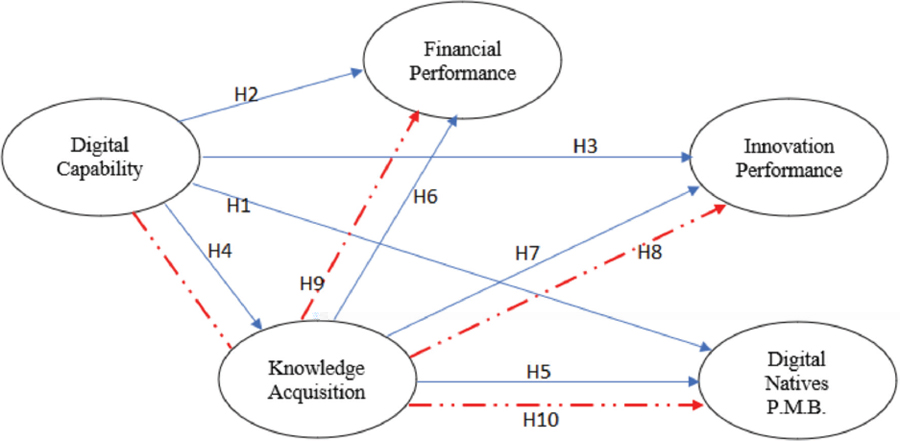

FIGURE 1. RESEARCH MODEL

THE BANK’S EFFECT ON DIGITAL CAPABILITY AND KNOWLEDGE ACQUISITION WITHIN THE PERFORMANCE AND DIGITAL NATIVE’S PERCEPTION OF MOBILE BANKING

EL EFECTO DEL BANCO EN LA ADQUISICIÓN DE CAPACIDAD Y CONOCIMIENTO DIGITAL EN EL DESEMPEÑO Y LA PERCEPCIÓN DEL NATIVO DIGITAL SOBRE LA BANCA MÓVIL

Buket Aslan (Istanbul Medipol University, https://orcid.org/0000-0001-7618-5214)

Fatma Sonmez Cakir (Bartin University, https://orcid.org/0000-0001-5845-9162)

Zafer Adiguzel (Istanbul Medipol University, https://orcid.org/0000-0001-8743-356X)*

Abstract:

The aim of this study is to analyze the effects of digital skills and knowledge acquisition on the performance and digital natives perceptions of mobile banking as a result of the increase in the use of mobile banking applications with the spread of the internet. A survey was conducted with 337 white-collar specialists working in the general directorates of banks. The SmartPLS 3.3.3 program was used, and the obtained data were analyzed. Digital capability and knowledge acquisition have positive effects on both the performances and digital natives perceptions of mobile banking. It is supported by hypotheses that banks should give importance to digitalization and information. The research covers a specific sector within a certain field, since the data were obtained from the expert-level personnel working in the general directorates of banks in Istanbul. The results could also be applied to analyze the effective performance of other companies that provide services through mobile applications.

Keywords: digital capability, knowledge acquisition, financial performance, digital natives P.M.B., innovation performance.

JEL Codes: D83, L25, M10

Resumen:

El objetivo de este estudio es analizar los efectos de la adquisición de competencias y conocimientos digitales en el rendimiento y las percepciones de los nativos digitales sobre la banca móvil como consecuencia del aumento del uso de aplicaciones bancarias móviles con la difusión de Internet. Se realizó una encuesta a 337 técnicos administrativos que actúan en las direcciones generales de los bandos, cuyos datos fueron analizados con el programa SmartPLS 3.3.3. Entre los resultados destaca que la capacidad digital y la adquisición de conocimientos tienen efectos positivos tanto en los resultados como en las percepciones de los nativos digitales sobre la banca móvil. Las hipótesis apoyan que los bancos deben dar importancia a la digitalización y a la información. La investigación abarca un sector específico dentro de un ámbito determinado, ya que los datos se obtuvieron del personal experto que trabaja en las direcciones generales de los bancos de Estambul. Los resultados también podrían aplicarse para analizar el rendimiento efectivo de otras empresas que prestan servicios a través de aplicaciones móviles.

Palabras clave: capacidad digital, adquisición de conocimiento, desempeño financiero, nativos digitales P.M.B., desempeño en innovación.

Códigos JEL: D83, L25, M10

1. INTRODUCTION

Digital talent is an important resource for companies as correctly presenting products and services in the digital environment enables companies to achieve effective results- in every field. And, over time, the regular management of companies' digital products and services is reflected in their portfolios. According to Sirmon et al. (2007), digital talent is an intangible asset for companies that cannot easily be imitated. In fact, this is especially true in the banking sector because the internet and social networks are widespread, key for banks to reach more customers. In particular, mobile banking transactions have started to become more effective than traditional banking services. Due to changes in technology, mobile banking applications have managed to positively affect users' perceptions, and therefore, the demand for mobile banking services has begun to increase, compelling many banks and financial institutions to focus on the development of mobile banking applications that have multiple benefits: expanding customer reach and increasing customer retention, operational efficiency, and the company's market share (Shaikh, 2013). With the help of technological developments, banks strive to minimize company costs by developing strategies and services that emphasize improving their new products and ensuring customer satisfaction (Sohail & Shanmugham, 2003).

Over the last decade, in addition to their traditional branches, banks have invested more in technology-based services, such as ATMs and turned towards mobile banking and internet banking (Illia et al., 2015). Luo et al. (2010) emphasize that mobile banking services, which enable customers to access bank services at any time, can perform their transactions anywhere without speaking to a bank employee, like traditional banking services. Shaikh and Karjaluoto (2015) state that research in the literature focuses on digitalization or other technological factors for the spread of mobile banking, and consumer attitudes and perceptions towards mobile banking technology are also affected.

For successful transformation and competition to occur, companies must bridge the gaps between digitization and digital talent demand and supply (Cardenas-Navia & Fitzgerald, 2019). As stated by Kazan et al. (2018), digital platforms represent an emerging area in company performance. And, Bhatt and Bhatt (2016) explain that thanks to mobile banking, people can perform their banking transactions by themselves and gain the competitive advantage in the financial markets by accelerating these transactions at the least cost. For this reason, it is predicted that digital talent and knowledge acquisition positively affect the perception of mobile banking as well as the financial and innovation performance of banks. Considering the technological developments and diversity offered in mobile banking, a literature search was carried out by taking into account the state of knowledge about mobile banking and its general adoption in the research. The aim of this study is to investigate and analyze the effects of digital talent and knowledge acquisition on financial performance, innovation performance, and mobile banking perceptions of digital users within the scope of survey data obtained from the financial sector.

2. LITERATURE

2.1. Digital Capability

In the early 1980s, digital capabilities were defined as the ability to use technological information efficiently and the competence of using technological information (Son et al., 2021). Zhe and Hamid (2021) considered digital talent as a necessary skill for companies to produce and manage. Furthermore, digital transformation and the use of new technology are considered both efficient and strategically important for companies (Fitzgerald et al., 2014). While a company's technological capability is an important component of its information flow, digital capability is a key component for a company's sustainable and long-term competitive advantage (Lee et al., 2001). Digital capabilities, with their ability to perceive and respond, increase the ability of companies to both understand the needs of customers and compete in the market (Freitas Junior et al., 2016), and digitalization enables people to have the ability to use their behaviors and abilities within differing working environments. In other words, proper management of digital talent can support companies in achieving higher performance (Bauters et al., 2018).

Although digital talent is not generally seen as one of the most important sources of sustainable competitive advantage, it is seen as an important resource (Karneli et al., 2021): an intangible asset that is difficult to imitate in the marketplace. Digital capabilities are valuable to companies because they support product improvements that increase the value of their products, in addition to processing improvements that allow for a reduced cost structure. Indeed, other companies that do not have similar technological capabilities have difficulty understanding why and how product and process improvements are made (Coombs & Bierly, 2006). Technologically oriented companies have the ability to acquire technological knowledge and apply this knowledge in the operation process. For this reason, the development, use and adaptation of companies' digital talent affects performance (Ray, 2008), while also generating innovative ideas and better product designs (Al-Henzab et al., 2018). For this reason, companies can improve their knowledge by internalizing new ideas and information thanks to digital talent (Salisu & Bakar, 2019). In the research, the effects of digital capability and knowledge acquisition on financial performance, innovation performance, and digital natives perceptions of mobile banking are examined.

2.2. Knowledge Acquisition

“What is information” and “What is right?” It is as difficult to ask as it is to answer (Zagzebski, 2017). In terms of information, there is no generally accepted definition of knowledge (Fiore et al., 2018), but in its simplest form, knowledge is an entity that encompasses all human activities in terms of data with recognizable patterns of meaning and the capacity to act towards making individual decisions within the possibility of time (Rowley & Hartley, 2017). Ironically, searching for information and browsing (or browsing) are thought of as two different concepts (Dinet et al., 2012). Scanning is a “looking”-oriented activity that individuals do before seeking to clarify needed information about their decisions (Monroe & Xia, 2005). And, often information is obtained, before it has a clear purpose (Detlor et al., 2003). On this basis, interactive channels provide information in accordance with the purpose of the research (Van Noort et al., 2012). For example, a well-designed general information search site is likely to help provide a positive user experience and thus re-search for information on that site (Chung & Tan, 2004).

Information seeking is a complex cognitive activity that usually includes sensory, contextual and social factors (Dinet et al., 2012) and requires a conscious effort to acquire information in response to a lack of information. On the other hand, information seeking behavior represents the information behavior component, such as the quality of the information, its original context, format, target audience, perceived usefulness, interest level and cognitive level features (Knight & Spink, 2008). In this context, obtaining information is the series of activities carried out directly or indirectly about a product, brand, service or company (Xie et al., 2018). Intention to acquire information can be made towards learning (or test information), information gathering, and information seeking activity related to the specific problem (Mahnke et al., 2012). For this reason, it is possible to achieve better performance if the information shared in the digital field is used correctly thanks to the acquisition of knowledge. Within the scope of the research, the effects of obtaining information on performance in banks and digital natives perceptions of mobile banking, both as independent and mediating variables, are examined.

2.3. Digital Natives Perceptions of Mobile Banking

The mobile banking sector began to develop in the 1980s, with many banks teaching their customers by personally offering mobile banking. As a result, web-based information exchanges online became simpler for customers using modern purchasing activities and systems. The term mobile banking refers to banking activities carried out through mobile internet technologies (Chong, 2013), and mobile banking is defined as a channel through which the consumer interacts with a bank (Laukkanen & Passanen, 2008). Over the past decade, consumers have rapidly and easily adapted to new digital mobile devices, and Afshan and Sharif (2016) state in their research that technological innovations significantly benefit the banking and commercial sectors and allow banks to better serve their customers. Today, mobile banking services have developed as a new retail channel for banks with plans to gain more customers by promoting and developing mobile banking services, and thus, reach their strategic goals (Aboelmaged & Gebba, 2013). According to Laforet and Li (2005), mobile banking makes it easy for users to access banking services wherever there is internet. McKnight et al. (2002) stated in their research that mobile banking users save time and have payment opportunities everywhere. In order to adopt and use mobile banking, which provides convenience to users thanks to these opportunities, mobile banking must be secure: a solid and adequate interaction between mobile devices and users. As a result of the research in the literature, the effects of digital talent and knowledge acquisition on digital natives perceptions of mobile banking are examined.

2.4. Financial Performance

Okafor et al. (2021), in general, emphasize that financial performance is a very important factor for a company to successfully remain in the market. Horváth and Szabó (2019) state that, compared to traditional production, technology-based production and service developments give companies a clear advantage and are important for companies to stay in the market and develop. Cheng et al. (2018) maintain that it is not possible for companies to compete and survive with traditional production models in a competitive environment; therefore, companies must have technological competence in order to improve their financial performance. This competitive advantage helps companies reduce their costs and improve their financial performance by improving their profit margins through the increase in sales- thanks to technology (Kiel et al., 2017). Financial performance is one of the most important factors for a company's growth and survival, and Murphy et al. (1996) measured the effects of financial performance on company performance, including a company’s success, failure, productivity, and market share. In this case, we can predict how important financial performance is for companies.

According to Waldrop (2016), companies that use the latest technologies and are advantageous in terms of technology should give importance to software in order to gain a financial advantage and achieve a higher financial performance. Technologically leading companies provide critical competitive advantage in both the short term and long term. In this direction, banks need to act in line with the needs and wishes of their customers while developing their new products/services, also important for effective resource management, successful technology development management, and the adequacy of new technology (Park et al., 2021). Zhong et al. (2017) noted that firms plan and implement financial inputs every year, and based on these plans, firms can achieve targeted financial performance. For this reason, we can predict that digital talent and knowledge acquisition can have a positive effect on financial performance.

2.5. Innovation Performance

Performance is the fulfillment of organizational goals, and specifically, the comparison of the expected and actual results as the outputs of those implemented during the innovation process shows innovation performance. Today, innovation is seen as an important element. in that services and technologies are effective in changing the minds of customers. This is why innovation provides companies with significant gains and benefits. With the increasing prevalence of globalization, the importance of innovation performance has increased, and as a result, competition between businesses gains importance. With the developing information networks, companies have aimed to maintain this advantage by changing their structures to gain an advantage. However, it is said that the advantage to be protected brings with it continuous strategic changes in companies (Wijekoon et al., 2021). In short, innovation performance is defined as the use of new methods and processes by organizations, as well as the delivery of new products to the market by organizations, and the use of new devices and equipment (Dedahanov et al., 2017).

Innovation performance is the evaluation of applications and outputs for innovation and the comparison of expected and actual results (Waheed et al., 2019), and innovation activities and processes affect innovation performance. Therefore, all variables and outputs that will affect this process play an important role in innovation efficiency. In the evaluation of innovation performance, indicators such as technology, market share determinations, patents, and the number of new products are evidence of innovation success (Pan et al., 2019). Particularly, innovation performance depends on the innovative capabilities of an organization and the internal and external interaction of employees. Considering the increasing importance of innovation for the competitive position of organizations, and the fact that innovation has been shown to be one of the drivers of 20th century growth, the impact of alternative management mechanisms on the innovation performance of companies is an important issue (Chen et al., 2018). Innovation performance is the degree of innovation that is necessary for the continuation of business activities and competitiveness, showing the ways to achieve high performance and different advantages that develop within the business (Andersson et al., 2020). As a result of the research in the literature, the effects of digital capability and knowledge acquisition on innovation performance are examined.

2.6. Examining the Relationships Between the Variables

According to Moorman and Slotegraaf (1999), a company's digital capability ensures its success in formulating and developing new products. It is argued that digital talent means “a company developing the ability, capability and expertise to manage digital technologies for a new product.” Carcary et al. (2016), on the other hand, states that for a successful digital transformation, a company that can develop various digital capabilities in different areas should develop its capabilities depending on the sector and the specific needs of the company. Clearly, digital capability has positive effects on business performance and digital innovation (Yasa et al., 2019). And, as Park et al. (2021) state, it has been proven that digital talent has a positive effect on financial performance. Looking at the studies on knowledge acquisition, Bloodgood (2019) states that knowledge acquisition can have important competitive effects on companies, such as harm and opportunity against competitors. Xie et al. (2018) emphasize in their research that the acquisition of knowledge among organizations positively affects radical innovation, and Ngoc Thang and Anh Tuan (2020) explain in their research that acquiring knowledge positively affects firm innovation, while Kim et al. (2021) stated in their research that knowledge acquisition of firms has a positive effect on financial performance. . Innovative performance, the degree to which businesses enter the market through inventions, can be implemented as an indicator of innovative performance. Furthermore, it is necessary to focus on both the technical aspects of innovation and the introduction of new products to the market (Buenechea-Elberdin et al., 2018). The hypotheses tested as a result of these studies are;

H1: The digital capability of banks has a positive effect on digital natives PMB.

H2: The digital capability of banks has a positive effect on financial performance.

H3: The digital capability of banks has a positive effect on innovation performance.

H4: The digital capability of banks has a positive effect on knowledge acquisition.

H5: The knowledge acquisition of banks has a positive effect on digital natives PMB.

H6: The knowledge acquisition of banks has a positive effect on financial performance.

H7: The knowledge acquisition of banks has a positive effect on innovation performance.

H8: There is a mediation variable effect of knowledge acquisition between digital innovation and innovation performance in banks.

H9: There is a mediation variable effect of knowledge acquisition between digital innovation and financial performance in banks.

H10: There is a mediation variable effect on knowledge acquisition between digital talent and digital natives PMB in banks.

3. METHODOLOGY

The research model is given in Figure 1. In this figure, dashed red lines are used to show mediator effects, solid lines are used to show direct effects between one variable and another. Figure 1 also shows the hypotheses established for the Model. Accordingly, 7 direct effects and 3 mediation effects were analyzed in the model, including Digital capability's financial performance, innovation performance, knowledge acquisition and digital natives perceptions of mobile banking; The direct positive effects of knowledge acquisition on innovation performance, financial performance, and digital natives perceptions of mobile banking, in addition to the mediating variable effects of knowledge acquisition were analyzed. Partial Least Square Structural Equation Modeling was used in the analysis. In this way, the path coefficients between the variables were obtained. SmartPLS 3.3.3 was used to perform the transactions. This version is the latest version available.

FIGURE 1. RESEARCH MODEL

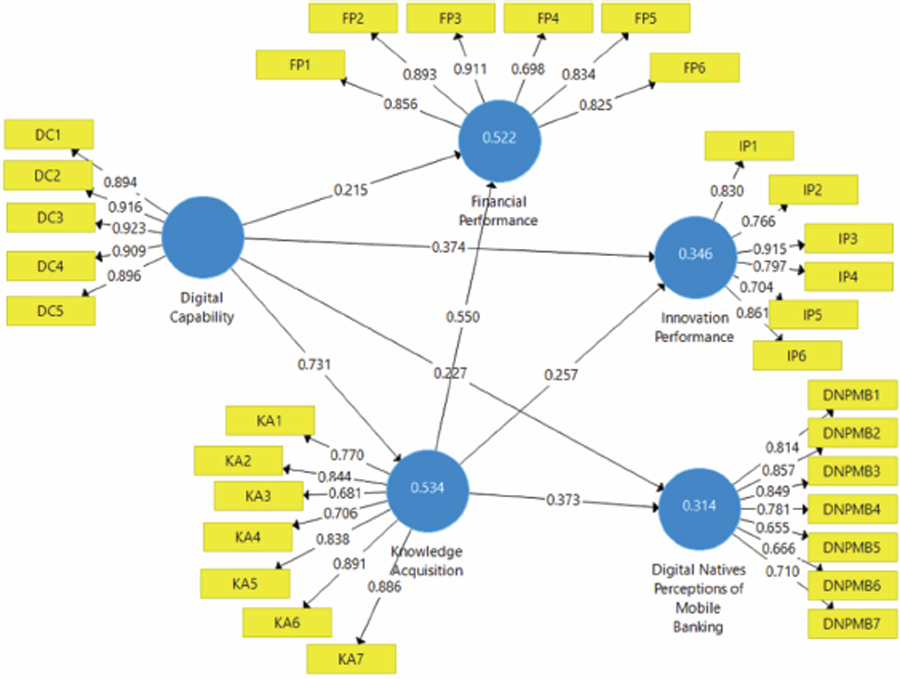

After the data sets were organized, variable and path definitions were made to the program. Accordingly, the model given in Figure 2 was tested.

FIGURE 2. INNER MODEL FOR RESEARCH

In Figure 2, the variables and the expressions that the variables have are given. It has five statements: digital capability-5, financial performance-6, innovation performance-6, knowledge acquisition-7, and digital natives perceptions of mobile banking-7. The meanings and explanations of the numerical representations in Figure 2 are given in Table 1.

TABLE 1. FACTOR ANALYSIS RESULTS

|

|

Outer Loadings |

Outer Weights |

Adj.R Square |

Outer Loadings t-Stat. |

Outer VIF |

Digital Capability (DC) |

DC1. The latest digital technologies are used in the company where I work. |

0,894 |

0,212 |

|

52,687* |

3,632 |

DC2. Discovering the latest digital opportunities at the company I work for. |

0,916 |

0,217 |

74,047* |

4,083 |

||

DC3. The company I work for adapts to digital transformation. |

0,923 |

0,226 |

82,935* |

4,362 |

||

DC4. The company I work for has the latest digital technologies. |

0,909 |

0,217 |

76,890* |

3,864 |

||

DC5. Innovative products/services/processes are developed by using digital technology in my company. |

0,896 |

0,230 |

61,718* |

3,508 |

||

Digital Natives Perceptions of Mobile Banking (DNPMB) |

DNPMB1. Financial information is protected in the company I work for. |

0,814 |

0,268 |

0,310 |

30,509* |

3,875 |

DNPMB2. In the company I work for, unauthorized persons cannot access the accounts. |

0,857 |

0,269 |

31,434* |

4,580 |

||

DNPMB3. The information technology infrastructure in the company I work for is secure. |

0,849 |

0,204 |

33,412* |

2,618 |

||

DNPMB4. It is difficult to hack the web page of the company I work for. |

0,781 |

0,160 |

19,136* |

2,476 |

||

DNPMB5. Financial data is kept confidential in the company I work for. |

0,655 |

0,107 |

10,528* |

2,287 |

||

DNPMB6. In general, mobile banking can be trusted at my company. |

0,666 |

0,120 |

11,088* |

2,671 |

||

DNPMB7. The latest new mobile banking applications are used in the company I work for. |

0,710 |

0,145 |

12,893* |

2,770 |

||

Financial Performance (FP) |

FP1. The company I work for has a good return on investment compared to competitors. |

0,856 |

0,238 |

0,519 |

56,468* |

2,774 |

FP2. Sales growth is good in my company compared to competitors. |

0,893 |

0,220 |

54,072* |

3,765 |

||

FP3. In the company I work for, the return on assets is good compared to the competitors. |

0,911 |

0,236 |

88,335* |

4,081 |

||

FP4. In the company I work for, the costs are at the minimum level compared to the competitors. |

0,698 |

0,143 |

19,729* |

1,646 |

||

FP5. The average profit of the company I work for is better compared to the competitors. |

0,834 |

0,164 |

34,525* |

3,327 |

||

FP6. The profit growth of the company I work for is better compared to the competitors. |

0,825 |

0,180 |

34,447* |

3,033 |

||

Innovation Performance (IP) |

IP1. The latest technological innovations are used in our products/services at the company I work for. |

0,830 |

0,224 |

0,342 |

28,429* |

2,265 |

IP2. The rate of new product/service development is high in the company I work for. |

0,766 |

0,172 |

15,411* |

2,357 |

||

IP3. The newest products/services are offered in the company I work for. |

0,915 |

0,261 |

66,650* |

4,072 |

||

IP4. The speed of adopting the latest technological innovations in the processes of the company I work for is good. |

0,797 |

0,207 |

17,478* |

2,145 |

||

IP5. The technological competitiveness of the company I work for is in good condition. |

0,704 |

0,117 |

8,376* |

2,096 |

||

IP6. The technology used in the processes of the company I work for is up-to-date. |

0,861 |

0,227 |

35,976* |

2,857 |

||

Knowledge Acquisition (KA) |

KA1. Collaboration agreements with other companies are supported in the company where I work. |

0,770 |

0,175 |

0,533 |

25,477* |

2,180 |

KA2. The company I work in is in contact with the outside professionals and expert technicians. |

0,844 |

0,194 |

43,955* |

2,789 |

||

KA3. The organization I work for encourages employees to join formal or informal networks of people from outside the organization. |

0,681 |

0,142 |

17,752* |

1,654 |

||

KA4. Employees of the company I work for regularly attend fairs and exhibitions. |

0,706 |

0,131 |

21,319* |

1,800 |

||

KA5. The company I work for has an R&D policy. |

0,838 |

0,179 |

36,571* |

2,845 |

||

KA6. New ideas and approaches are constantly being tested in the company I work for. |

0,891 |

0,197 |

71,542* |

4,040 |

||

KA7. The procedures of the company I work for support innovation. |

0,886 |

0,210 |

62,540* |

3,687 |

*All p value<0.05.

3.1. Research Population, Sampling and Demographic Data

For the research, data were collected from authorized personnel at the expert level working at the banks' headquarters in Istanbul. Since the headquarters of banks in Turkey are located in Istanbul, authorized experts working in the general directorates of banks constitute the sample group. Banks were preferred for the intense use of digital technology with both internet and mobile applications. Therefore, banks were found suitable to empirically test our research model. The reason why the data were collected from the general directorates of the banks in the research is that the authorized specialist personnel work in the general directorates, and the questions about the variables examined in the research model concern the authorized specialists within the general directorate.

An online questionnaire was used as a data collection tool. These questionnaires were sent via e-mail to target participants- experts/administrators. The study was conducted between December 2020 and April 2021 under pandemic conditions. Out of 1500 e-mails sent, 337 questionnaires were returned. In order not to lose the data, the questions in the online survey are marked as “necessary.” Since participation in the survey is on a voluntary basis, involuntary answers were prevented. Since the questions might have been considered unnecessarily long, thereby affecting the participants, the scale expressions used in the formation of the statements are presented in both Turkish and English in order to obtain the best explanatory power. The desired participant was able to participate by changing their language preference. Before the scales were included in the analysis, their internal consistency was checked. Since the 337-unit questionnaire was sufficient for 80 percent power, 0.05 significance level, and 6 variables, questionnaire answering was stopped.

At this power and significance level, 130 units are sufficient for 6 variables based on a minimum R2 of 0.10 (Hair et al., 2017). In order not to encounter the common method variance problem, the respondents were given sufficient time, the number of questions was kept low, and anonymity was ensured.

Reflective for the model? Formative? Confirmatory Tetrad Analysis was performed to reveal that All CI low and CI up values were compared with each other (-, +) structures were observed and there were reflective models in the model. Analyzes and comments are given over the reflective model structure.

3.2. Scales

The statements in the scale were taken from previous publications. In these publications, the reliability and validity tests were performed, the scales were compiled, and the scale form was created.

Digital capability scale; Khin and Ho (2020) (Cronbach's Alpha=0.905) used the scale in their research. Knowledge acquisition scale; Liao (2018) (Cronbach's Alpha=0.930) used the scale in their research. Financial performance scale; According to Danso et al. (2020) (Cronbach's Alpha=0.950) used the scale in their research. Innovation performance scale; Prajogo and Ahmed (2006) (Cronbach's Alpha=0.870) used the scale in their research. Scale of Digital Natives Perceptions of Mobile Banking, Payne et al. (2018) (Cronbach's Alpha=0.950), the scale in their research was used.

The scale form consists of 2 groups of questions. In the first group, three demographic questions were asked: age, gender, and province of activity. In the second group, the expressions obtained from the literature review for the five variables used were given with a five-point Likert scale. Participants were asked to rate these statements (5: Strongly Agree - 1: Strongly Disagree). With these obtained scores, hypotheses were tested. The scale expressions used are given in Appendix 1.

4. ANALYZES

The PLS method has significantly fewer assumptions than analyzes with models containing covariance structures. It provides consistent results as in the analysis of covariance. It also gives consistent results in datasets where the sample size is relatively small. These features make PLS a useful application for hypothesis testing and model analysis. PLS can be used easily if the structures in the model are reflective and formative. Modeling results are given in accordance with both reflective and formative structure. In Table 1., outer loading, outer weight, r square, outer loadings t statistics and Outer Variance inflation factor (VIF) values are given and interpreted.

SmartPLS 3.3.3 in Table 1. The results of the analysis made in the package program are given. When the factorization results, factor loads, factor weights, reliability and validity values are appropriate, it will be decided that the model is suitable and path analysis can be started. Indicator loads should be greater than 0.7 to ensure indicator reliability for the model (Hair et al., 2017). When the outer loading column is examined, it can be seen that the smallest load value is 0.655. This value is less than 0.70, but since these values do not adversely affect the reliability and validity values calculated over factor loads, they were not excluded from the analysis. Whether the measurement model is reflective or formative, factor weights must be absolutely positive. Negative outer weights might be a result of high indicator collinearity (Ringle & Sarstedt, 2016). All outer weights values obtained as a result of the analysis are positive. R square values are coefficients of determination values and represent the explained variance and indicate how much of the variance a latent variable explains in an endegenous variable. R Square value is required to be greater than 0.26 (Cohen, 2013). The problem of multicollinearity that may arise between indicators is an important problem especially in formative measurement models. In case of high linearity, the standard errors will also increase, which will trigger the type II error (Cenfetelli & Bassellier, 2009). Variance inflation factor (VIF) values of 5 and higher indicate a potential collinearity problem (Hair et al., 2017). All of the VIF values given in Table 1 are below 5. Therefore, it can be easily said that there is no multicollinearity among the expressions in the data set. We can see if the outer loadings values are meaningful by interpreting the t statiscics values. The fact that these values are greater than the t value of 1.96 at the 5 per cent significance level indicates that there is a significant relationship between the expression and the variable. All of these values are greater than 1.96, and all of the P value values are less than 5 per cent.

In order to ensure internal consistency reliability in the model, Cronbach Alpha values and Composite Reliability values should be above 0.70. AVE should be greater than 0.50 meaning that 50 per cent or more variance of the indicators should be accounted for (Chin, 2010). at the same time, all AVE values must be less than their CR values. When these conditions are met, it can be said that the model has construct validity. Construct Reliability and Validity Values values are given in Table 2.

TABLE 2. CONSTRUCT RELIABILITY AND VALIDITY VALUES

|

Number of Items |

Cronbach's Alpha |

rho_A |

Composite Reliability (CR) |

Average Variance Extracted (AVE) |

DC |

5 |

0,947 |

0,947 |

0,959 |

0,824 |

DNPMP |

7 |

0,889 |

0,931 |

0,908 |

0,586 |

FP |

6 |

0,915 |

0,935 |

0,934 |

0,704 |

IP |

6 |

0,899 |

0,922 |

0,922 |

0,664 |

KA |

7 |

0,909 |

0,922 |

0,928 |

0,650 |

AVE of each latent construct should be higher than the construct's highest squared correlation with any other latent construct. According to the Fornell-Larcker criterion, if a variable is compared with itself, the value obtained should be the largest value of the row and column in which it is located. Bold and underlined values among the values given in Table 3. show the values calculated according to the Fornell-Larcker criterion. Values in italics are correlation coefficients. Htmt value is another ratio used in discriminant validity (Henseler et al., 2009). If this ratio is greater than 0.85 (Kline, 2011) or 0.90 (Gold et al., 2001), it means that Discriminant Validity has not been achieved. According to the results of the analysis, there is no problem in discriminant validity values or factorization. After the operations on the model structure, the hypotheses were tested.

TABLE 3. FORNELL-LARCKER CRITERION AND HETEROTRAIT-MONOTRAIT RATIO (HTMT) VALUES

|

Fornell-Larcker Criterion Value |

Heterotrait-Monotrait Ratio |

|||||||

|

DC |

DNPMB |

FP |

IP |

KA |

DC |

DNPMB |

FP |

IP |

DC |

0,908 |

|

|

|

|

|

|

|

|

DNPMP |

0,500 |

0,766 |

|

|

|

0,490 |

|

|

|

FP |

0,617 |

0,461 |

0,839 |

|

|

0,644 |

0,460 |

|

|

IP |

0,561 |

0,468 |

0,495 |

0,815 |

|

0,586 |

0,508 |

0,514 |

|

KA |

0,731 |

0,539 |

0,707 |

0,530 |

0,806 |

0,778 |

0,544 |

0,757 |

0,554 |

Path model results are given in Table 4. This model shows whether the established relationships are also supported by the model. The T statistics values of the Path Coefficient values for each hypothesis are greater than 1.96, the T table value of the 95 per cent confidence level. In addition, the P value of Path Coefficient values for all hypotheses is less than 0.05, resulting in the conclusion that all hypotheses are supported. That is, all direct effects paths in the model are significant.

TABLE 4. PATH COEFFICIENT AND CONFIDENCE INTERVALS VALUE

H |

Path |

O |

M |

STDEV |

2.5% |

97.5% |

T Stat. |

P Values |

Decission |

H1 |

DC→DNPMB |

0,226 |

0,231 |

0,083 |

0,074 |

0,397 |

2,711 |

0,007 |

Accept |

H2 |

DC→FP |

0,214 |

0,211 |

0,059 |

0,100 |

0,322 |

3,636 |

0,000 |

Accept |

H3 |

DC→IP |

0,374 |

0,373 |

0,075 |

0,232 |

0,516 |

4,979 |

0,000 |

Accept |

H4 |

DC→KA |

0,731 |

0,732 |

0,034 |

0,662 |

0,793 |

21,231 |

0,000 |

Accept |

H5 |

KA→DNPMB |

0,373 |

0,374 |

0,087 |

0,197 |

0,535 |

4,297 |

0,000 |

Accept |

H6 |

KA→FP |

0,550 |

0,554 |

0,055 |

0,446 |

0,657 |

9,994 |

0,000 |

Accept |

H7 |

KA→IP |

0,257 |

0,259 |

0,057 |

0,151 |

0,382 |

4,489 |

0,000 |

Accept |

O: Original Sample, M: Sample Mean.

In testing the hypotheses established for the mediation effect, it is necessary to look at the patf coefficient values again. Table 5 was created according to the path results obtained from the SmartPLS program. It can be seen that t values are greater than 1.96 and all p values are less than 0.05. This shows that all effect values are different from 0, that is, they are significant. The paths established for the hypotheses between H8-H10 were also found to be significant. Once these pathways are significant, the mediation effect size needs to be calculated. For this, VAF (Variance Accounted for) values have been calculated. The VAF value is used to calculate the ratio of the indirect effect to the total effect (Nitzl & Hirsch, 2016). Mediation effect sizes calculations are given in Table 6.

TABLE 5. MEDIATION EFFECT PATH RESULTS

H |

Path |

O |

M |

STDEV |

2.5% |

97.5% |

T Stat. |

P Values |

Decission |

H8 |

DC→KA→IP |

0,188 |

0,190 |

0,044 |

0,111 |

0,290 |

4,239 |

0,000 |

Accept |

H9 |

DC→KA→FP |

0,402 |

0,406 |

0,045 |

0,322 |

0,496 |

8,941 |

0,000 |

Accept |

H10 |

DC→KA→DNPMB |

0,273 |

0,273 |

0,063 |

0,142 |

0,387 |

4,310 |

0,000 |

Accept |

O: Original Sample, M: Sample Mean.

TABLE 6. MEDIATION EFFECT SIZE VALUE

H |

Path |

Path Coeff. (b) |

Path Coeff. (c) |

Total Indirect Effect |

Total Effect |

VAF |

Mediation |

H8 |

DC→KA→IP |

0,731 |

0,257 |

0,188 |

0,561 |

0,34 |

Accept |

H9 |

DC→KA→FP |

0,731 |

0,214 |

0,156 |

0,616 |

0,25 |

Accept |

H10 |

DC→KA→DNPMB |

0,731 |

0,226 |

0,165 |

0,499 |

0,33 |

Accept |

(b) is the Path value between the first hidden variable and the second hidden variable, and (c) is the Path coefficient between the second hidden variable and the third hidden variable. When these two coefficients are multiplied, the values seen in the Total Indirect effect table are obtained. VAF value for H8; VAF=0.188/0.561=0.34. If VAF values are below 20 per cent, zero mediator effect is mentioned, while 20 per cent-80 per cent VAF value means partial, and more than 80 per cent means full mediator effect (Hair et al., 2016).

5. DISCUSSION

In the research in which the effects of digital capability and knowledge acquisition in banks are investigated, the importance of digitalization and knowledge is explained by supporting the hypotheses in the analysis results. When comparing the results of the study with similar research results at the same time, Holzinger et al. (2007) argue that a bank's digitalization opportunity does not affect financial profitability, but instead, banks and companies in the financial sector should develop a clear vision for the development of digital innovation, being ahead of the competition, and taking risks. Park et al. (2021), as well, explain in their research that the financial performances of companies that focus on technology, that is, invest in digitalization, are positively affected. Since the success of digital product development depends on how well a company can manage digital technologies, digital talent in terms of technology is a key requirement for achieving digital innovation. As a result of the research conducted in banks, it is supported by the H2 hypothesis that digital capability is important and has positive effects. Therefore, having digital technology and developing new digital solutions, i.e. every step of digital innovation, shows the need for digital talents in terms of specialization (Khin & Ho, 2020). Renko et al. (2009) stated in their research that high levels of digital talent and competence are important resources required for innovation, and considering the analysis results along with these studies, it can be explained that digital capability is a concept that companies should attach importance to. Because Lu and Ramamurthy (2011) argue in their research that no matter how well technology is applied in an organization, there is a need for effective management of usage and services, that is, digital talent. That's why technology-driven companies that want high efficiency must develop innovative digital solutions that improve their organizations. Especially with the rapid change of technology, the fact that companies should be technology-oriented and adopt technology shows that they should have a culture of responding quickly to rapidly changing technology pressure and staying competitive. In this case, companies can positively affect their financial performance by investing and developing strategies in digital transformations (Sousa-Zomer et al., 2020). It is supported by the support of H1, H3 and H4 hypotheses and the results obtained in the researches that positive effects will be achieved with the possession of digital capabilities and the continuous development of digital capabilities. At the same time, looking at the studies examining the effects of knowledge acquisition, Li and Gao (2021) explain in their research that knowledge acquisition has a positive effect on the makers' innovation performance; research further supported by Li et al. (2020) discussed diversity of knowledge acquisition and its positive effects on innovation performance. Papa et al. (2020) stated in their research that acquiring knowledge positively affects innovation performance; additionally, Guo et al. (2019) showed that acquiring technical and market knowledge has a significant positive effect on both environmental performance and economic performance. As a result of the research conducted in banks, the positive effect of knowledge acquisition on innovation performance and financial performance supports this research. As a result of the analysis, it can be argued that the H5, H6, H7, H8, H9 and H10 hypotheses are supported. In addition, the fact that knowledge acquisition is important for companies shows that knowledge is valuable. Because in today's world and in the future, both the concepts of digitalization and information and artificial intelligence will continue to take place in all areas of our lives. For this reason, companies need to plan their knowledge and technological infrastructure by thinking about the future. It is not possible for companies that do not think about the future by falling behind digitalization and information to compete. As a result of the researches and analyzes, it is seen that digitalization and information acquisition are two important concepts that companies cannot give up.

6. CONCLUSION

Banks operating in the financial sector need to turn to digital technologies in order to reach their targeted strategies. Within the framework of this research, the effects of digital talent and knowledge acquisition on the dependent variables are analyzed as banks go digital. Moreover, digitalization is also important in an intensely competitive environment saturated with widespread use of the internet and smartphones. Thanks to digitalization, bank customers can perform their banking transactions wherever there is internet, and according to De Jong and Hartog (2010), digital capability is critical for the development of product innovation and the success of future companies. It is supported by the hypotheses in the research that digital capability has positive effects on the development of banking applications and innovation. According to Gilch and Sieweke (2021), companies should hire employees with digital talents and skills. For this reason, the data in the research were collected from authorized specialist employees of banks. As a result of the analysis of data collected from expert employees who are authorized to develop digitalization, it can be argued that companies in all sectors entering digital innovation should have digital talent. The lack of qualified employees, that is, employees with digital talents and skills, can lead to significant losses in the competitiveness of customers and companies. According to some reports, up to 54 per cent of companies admit their inadequacy in digital skills, and it is stated that this inadequacy of digital capabilities hinders digital innovation (Buvat et al., 2017). In this case, it is possible that banks' inadequacy in digitalization may cause a loss of customers, as well as a negative effect on their finance and innovation performance. It is supported by the hypotheses that the digitization of banks positively affects both the performance and the perception of mobile banking. In other words, investing in digitalization and giving importance to digitalization is a necessity for banks. The results of the research show that successful digitalization contributes positively to financial performance, and the fact that employees have a mentality that adapts to the digital age (and have digital knowledge) contributes to the higher financial performance of companies. The findings of our study reached similar results as in the literature. In the research, the importance and effects of digital skills and knowledge acquisition for banks were examined and the results of the analysis were interpreted.

6.1. Managerial implications

Digital capabilities and knowledge acquisition are two important concepts that should be considered by managers of companies in the financial sector. Companies in the financial sector need to foresee the future, analyze the information they have well, create brainstorming and make the right decisions and make investments in the field of digitalization. At the same time, they need to take into account the importance of knowledge acquisition and establish R&D centers where they can benefit from data science and lay the foundations for decisions that will provide an advantage over their competitors.

6.2. Practical implications

In line with the results obtained in the research, it can be argued that digitalization is now important for all companies and companies should attach importance to digitalization in order to positively affect performance outputs. It is not possible for companies that do not attach importance to digitalization and do not understand the value of information to exist in the future. For this reason, companies need to fulfill the requirements of the age in order to ensure sustainability.

6.3. Limitations and future research

There are some limitations to the research as it was carried out only by collecting data from the general directorates of banks and from white-collar experts at the expert level. The reason for these limitations is that it is not possible to collect the answers to the questions about the variables representing the research model we examined from the general employees in the banks, so questionnaires were collected from authorized specialist employees who have the authority and responsibility to make decisions in banks. In this way, it has been verified by factor and reliability analyzes that the questions are understood by the experts. If the questions were collected from the general employees, the reliability of the analyzes would be open to discussion since we are likely to have problems in factor and reliability analyzes. It is recommended to conduct such researches especially in companies where digitalization and artificial intelligence are used extensively.

REFERENCES

Aboelmaged, M., & Gebba, T. R. (2013). Mobile banking adoption: an examination of technology acceptance model and theory of planned behavior. International Journal of Business Research and Development, 2(1). 35-50. DOI: https://doi.org/10.24102/ijbrd.v2i1.263

Afshan, S., & Sharif, A. (2016). Acceptance of mobile banking framework in Pakistan. Telematics and Informatics, 33(2), 370-387. Doi: https://doi.org/10.1016/j.tele.2015.09.005

Al-Henzab, J., Tarhini, A., & Obeidat, B. Y. (2018). The associations among market orientation, technology orientation, entrepreneurial orientation and organizational performance. Benchmarking: An International Journal, 25(8), 3117-3142. DOI: https://doi.org/10.1108/BIJ-02-2017-0024

Andersson, M., Moen, O., & Brett, P. O. (2020). The organizational climate for psychological safety: Associations with SMEs' innovation capabilities and innovation performance. Journal of Engineering and Technology Management, 55, 1-13. DOI: https://doi.org/10.1016/j.jengtecman.2020.101554

Bauters, K., Cottyn, J., Claeys, D., Slembrouck, M., Veelaert, P., & Van Landeghem, H. (2018). Automated work cycle classification and performance measurement for manual work stations. Robotics and Computer-Integrated Manufacturing, 51, 139-157. DOI: https://doi.org/10.1016/j.rcim.2017.12.001

Bhatt, A., & Bhatt, S. (2016). Factors affecting customers adoption of mobile banking services. The Journal of Internet Banking and Commerce, 21(1), 1-22.

Bloodgood, J. M. (2019). Knowledge acquisition and firm competitiveness: the role of complements and knowledge source. Journal of Knowledge Management, 23(1), 46-66. DOI: https://doi.org/10.1108/JKM-09-2017-0430

Buenechea-Elberdin, M., Sáenz, J., & Kianto, A. (2018). Knowledge management strategies, intellectual capital, and innovation performance: a comparison between high-and low-tech firms. Journal of Knowledge Management, 22(8), 1757-1781. DOI: https://doi.org/10.1108/JKM-04-2017-0150

Buvat, J., Solis, B., Crummenerl, C., Aboud, C., Kar, K., El Aoufi, H., & Sengupta, A. (2017). The digital culture challenge: closing the employee-leadership gap. Capgemini Digital Transformation Institute Survey. Paris: Capgemini Digital Transformation Institute.

Carcary, M., Doherty, E., & Conway, G. (2016, September). A dynamic capability approach to digital transformation: a focus on key foundational themes. In The European Conference on Information Systems Management (p. 20). Academic Conferences International Limited.

Cardenas-Navia, I., & Fitzgerald, B. K. (2019). The digital dilemma: Winning and losing strategies in the digital talent race. Industry and Higher Education, 33(3), 214-217. DOI: https://doi.org/10.1177/0950422219836669

Cenfetelli, R. T., & Bassellier, G. (2009). Interpretation of formative measurement in information systems research. MIS quarterly, 33(4), 689-707. DOI: https://doi.org/10.2307/20650323

Chen, Z., Huang, S., Liu, C., Min, M., & Zhou, L. (2018). Fit between organizational culture and innovation strategy: Implications for innovation performance. Sustainability, 10(10), 1-18. DOI: https://doi.org/10.3390/su10103378

Cheng, Y., Chen, K., Sun, H., Zhang, Y., & Tao, F. (2018). Data and knowledge mining with big data towards smart production. Journal of Industrial Information Integration, 9, 1-13. DOI: https://doi.org/10.1016/j.jii.2017.08.001

Chin, W. W. (2010). How to write up and report PLS analyses. In Handbook of partial least squares (pp. 655-690). Springer, Berlin, Heidelberg. DOI: https://doi.org/10.1007/978-3-540-32827-8_29

Chong, A. Y. L. (2013). Predicting m-commerce adoption determinants: A neural network approach. Expert Systems with Applications, 40(2), 523-530. DOI: https://doi.org/10.1016/j.eswa.2012.07.068

Chung, J., & Tan, F. B. (2004). Antecedents of perceived playfulness: an exploratory study on user acceptance of general information-searching websites. Information & Management, 41(7), 869-881. DOI: https://doi.org/10.1016/j.im.2003.08.016

Cohen, J. (2013). Statistical power analysis for the behavioral sciences. Academic press. DOI: https://doi.org/10.4324/9780203771587

Coombs, J. E., & Bierly III, P. E. (2006). Measuring technological capability and performance. R&D Management, 36(4), 421-438. DOI: https://doi.org/10.1111/j.1467-9310.2006.00444.x

Danso, A., Adomako, S., Lartey, T., Amankwah-Amoah, J., & Owusu-Yirenkyi, D. (2020). Stakeholder integration, environmental sustainability orientation and financial performance. Journal of business research, 119, 652-662. DOI: https://doi.org/10.1016/j.jbusres.2019.02.038

De Jong, J., & Den Hartog, D. (2010). Measuring innovative work behaviour. Creativity and innovation management, 19(1), 23-36. DOI: https://doi.org/10.1111/j.1467-8691.2010.00547.x

Dedahanov, A. T., Rhee, C., & Yoon, J. (2017). Organizational structure and innovation performance. Career Development International, 22(4), 334-350. DOI: https://doi.org/10.1108/CDI-12-2016-0234

Detlor, B., Sproule, S., & Gupta, C. (2003). Pre-purchase online information seeking: Search versus browse. Journal of Electronic Commerce Research, 4(2), 72-84.

Dinet, J., Chevalier, A., & Tricot, A. (2012). Information search activity: An overview. European review of applied psychology, 62(2), 49-62. DOI: https://doi.org/10.1016/j.erap.2012.03.004

Fiore, S. M., Elias, J., Salas, E., Warner, N. W., & Letsky, M. P. (2018). From data, to information, to knowledge: Measuring knowledge building in the context of collaborative cognition. In Macrocognition metrics and scenarios (pp. 179-200). CRC Press. Doi: https://doi.org/10.1201/9781315593173-14

Fitzgerald, M., Kruschwitz, N., Bonnet, D., & Welch, M. (2014). Embracing digital technology: A new strategic imperative. MIT sloan management review, 55(2), 1-12.

Freitas Junior, J. C., Maçada, A. C., Brinkhues, R., & Montesdioca, G. (2016). Digital capabilities as driver to digital business performance, Emergent Research Forum Papers, Twenty-second Americas Conference on Information Systems, San Diego, 1-5.

Gilch, P. M., & Sieweke, J. (2021). Recruiting digital talent: The strategic role of recruitment in organisations’ digital transformation. German Journal of Human Resource Management, 35(1), 53-82. DOI: https://doi.org/10.1177/2397002220952734

Gold, A. H., Malhotra, A., & Segars, A. H. (2001). Knowledge management: an organizational capabilities perspective. Journal of Management Information Systems, 18(1), 185–214. DOI: https://doi.org/10.1080/07421222.2001.11045669

Guo, Y., Wang, L., Wang, M., & Zhang, X. (2019). The mediating role of environmental innovation on knowledge acquisition and corporate performance relationship—A study of SMEs in China. Sustainability, 11(8), 1-18. DOI: https://doi.org/10.3390/su11082315

Hair Jr, J. F., Sarstedt, M., Matthews, L. M., & Ringle, C. M. (2016). Identifying and treating unobserved heterogeneity with FIMIX-PLS: part I–method. European Business Review, 28(1), 63-76. DOI: https://doi.org/10.1108/EBR-09-2015-0094

Hair, J. F., Hult, G. T. M., Ringle, C. M., Sarstedt, M., & Thiele, K. O. (2017). Mirror, mirror on the wall: a comparative evaluation of composite-based structural equation modeling methods. Journal of the academy of marketing science, 45(5), 616-632. DOI: https://doi.org/10.1007/s11747-017-0517-x

Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The Use of Partial Least Squares Path Modeling in International Marketing. Advances in International Marketing, Bingley: Emerald, 277-320. DOI: https://doi.org/10.1108/S1474-7979(2009)0000020014

Holzinger, A., Searle, G., & Nischelwitzer, A. (2007). On some aspects of improving mobile applications for the elderly. In International Conference on Universal Access in Human-Computer Interaction (pp. 923-932). Springer, Berlin, Heidelberg. DOI: https://doi.org/10.1007/978-3-540-73279-2_103

Horváth, D., & Szabó, R. Z. (2019). Driving forces and barriers of Industry 4.0: Do multinational and small and medium-sized companies have equal opportunities?. Technological Forecasting and Social Change, 146, 119-132. DOI: https://doi.org/10.1016/j.techfore.2019.05.021

Illia, A., Ngniatedema, T., & Huang, Z. (2015). A Conceptual Model for Mobile Banking Adoption. Journal of Management Information and Decision Sciences, 18(1), 111-122.

Karneli, O., Heriyanto, M., Febrian, A. F., Ngatno, N., Purnomo, M., & Rulinawaty, R. (2021). Measurement of sustainable competitive advantages through digital capability and innovation strategy: an empirical study in Indonesia. The Journal of Asian Finance, Economics and Business, 8(6), 1121-1128.

Kazan, E., Tan, C. W., Lim, E. T., Sørensen, C., & Damsgaard, J. (2018). Disentangling digital platform competition: The case of UK mobile payment platforms. Journal of Management Information Systems, 35(1), 180-219. DOI: https://doi.org/10.1080/07421222.2018.1440772

Khin, S., & Ho, T. C. (2020). Digital technology, digital capability and organizational performance: A mediating role of digital innovation. International Journal of Innovation Science, 11(2), 177-195. DOI: https://doi.org/10.1108/IJIS-08-2018-0083

Kiel, D., Arnold, C., & Voigt, K. I. (2017). The influence of the Industrial Internet of Things on business models of established manufacturing companies–A business level perspective. Technovation, 68, 4-19. DOI: https://doi.org/10.1016/j.technovation.2017.09.003

Kim, C. Y., Seo, E. H., Booranabanyat, C., & Kim, K. (2021). Effects of Emerging-Economy Firms’ Knowledge Acquisition from an Advanced International Joint Venture Partner on Their Financial Performance Based on the Open Innovation Perspective. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 1-21. DOI: https://doi.org/10.3390/joitmc7010067

Kline, R. B. (2011). Principles and practice of structural equation. Modeling (3nd), New York, NY: Guilford.

Knight, S. A., & Spink, A. (2008). Toward a web search information behavior model. In Web search (pp. 209-234). Springer, Berlin, Heidelberg. DOI: https://doi.org/10.1007/978-3-540-75829-7_12

Laforet, S., & Li, X. (2005). Consumers’ attitudes towards online and mobile banking in China. International journal of bank marketing. 23(5), 362-380. DOI: https://doi.org/10.1108/02652320510629250

Laukkanen, T., & Pasanen, M. (2008). Mobile banking innovators and early adopters: How they differ from other online users?. Journal of Financial Services Marketing, 13(2), 86-94. DOI: https://doi.org/10.1057/palgrave.fsm.4760077

Lee, C., Lee, K., & Pennings, J. M. (2001). Internal capabilities, external networks, and performance: a study on technology-based ventures. Strategic management journal, 22(6-7), 615-640. DOI: https://doi.org/10.1002/smj.181

Li, Q., Guo, J. J., Liu, W., Yue, X. G., Duarte, N., & Pereira, C. (2020). How knowledge acquisition diversity affects innovation performance during the technological catch-up in emerging economies: a moderated inverse u-shape relationship. Sustainability, 12(3), 1-19. DOI: https://doi.org/10.3390/su12030945

Li, Z., & Gao, X. (2021). Makers’ relationship network, knowledge acquisition and innovation performance: An empirical analysis from China. Technology in Society, 66, 1-9. https://doi.org/10.1016/j.techsoc.2021.101684

Liao, Z. (2018). Institutional pressure, knowledge acquisition and a firm's environmental innovation. Business Strategy and the Environment, 27(7), 849-857. DOI: https://doi.org/10.1002/bse.2036

Lu, Y., & K.(Ram) Ramamurthy. (2011). Understanding the link between information technology capability and organizational agility: An empirical examination. MIS quarterly, 35(4), 931-954.M. DOI: https://doi.org/10.2307/41409967

Luo, X., Li, H., Zhang, J., & Shim, J. P. (2010). Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: An empirical study of mobile banking services. Decision support systems, 49(2), 222-234. DOI: https://doi.org/10.1016/j.dss.2010.02.008

Mahnke, V., Ambos, B., Nell, P. C., & Hobdari, B. (2012). How do regional headquarters influence corporate decisions in networked MNCs?. Journal of International Management, 18(3), 293-301. DOI: https://doi.org/10.1016/j.intman.2012.04.001

McKnight, D. H., Choudhury, V., & Kacmar, C. (2002). Developing and validating trust measures for e-commerce: An integrative typology. Information systems research, 13(3), 334-359. DOI: https://doi.org/10.1287/isre.13.3.334.81

Monroe, K. B., & Xia, L. (2005). Special Session Summary the Many Routes to Price Unfairness Perceptions. ACR North American Advances, 32, 387-390.

Moorman, C., & Slotegraaf, R. J. (1999). The contingency value of complementary capabilities in product development. Journal of Marketing Research, 36(2), 239-257. DOI: https://doi.org/10.1177/002224379903600208 https://doi.org/10.2307/3152096

Murphy, G. B., Trailer, J. W., & Hill, R. C. (1996). Measuring performance in entrepreneurship research. Journal of business research, 36(1), 15-23. DOI: https://doi.org/10.1016/0148-2963(95)00159-X

Ngoc Thang, N., & Anh Tuan, P. (2020). Knowledge acquisition, knowledge management strategy and innovation: An empirical study of Vietnamese firms. Cogent Business & Management, 7(1), 1-14. DOI: https://doi.org/10.1080/23311975.2020.1786314

Nitzl, C., & Hirsch, B. (2016). The drivers of a superior’s trust formation in his subordinate. Journal of Accounting & Organizational Change, 12(4), 472-503. DOI: https://doi.org/10.1108/JAOC-07-2015-0058

Okafor, A., Adeleye, B. N., & Adusei, M. (2021). Corporate social responsibility and financial performance: Evidence from US tech firms. Journal of Cleaner Production, 292, 1-11. DOI: https://doi.org/10.1016/j.jclepro.2021.126078

Pan, X., Song, M. L., Zhang, J., & Zhou, G. (2019). Innovation network, technological learning and innovation performance of high-tech cluster enterprises. Journal of Knowledge Management, 23(9), 1729-1746. DOI: https://doi.org/10.1108/JKM-06-2018-0371

Papa, A., Dezi, L., Gregori, G.L., Mueller, J. and Miglietta, N. (2020). "Improving innovation performance through knowledge acquisition: the moderating role of employee retention and human resource management practices", Journal of Knowledge Management, Vol. 24 No. 3, pp. 589-605. DOI: https://doi.org/10.1108/JKM-09-2017-0391

Park, J. H., Chung, H., Kim, K. H., Kim, J. J., & Lee, C. (2021). The Impact of Technological Capability on Financial Performance in the Semiconductor Industry. Sustainability, 13(2), 1-20. DOI: https://doi.org/10.3390/su13020489

Payne, E. M., Peltier, J. W., & Barger, V. A. (2018). Mobile banking and AI-enabled mobile banking: The differential effects of technological and non-technological factors on digital natives’ perceptions and behavior. Journal of Research in Interactive Marketing, 12(3), 328-346. DOI: https://doi.org/10.1108/JRIM-07-2018-0087

Prajogo, D. I., & Ahmed, P. K. (2006). Relationships between innovation stimulus, innovation capacity, and innovation performance. R&D Management, 36(5), 499-515. DOI: https://doi.org/10.1111/j.1467-9310.2006.00450.x

Ray, A. S. (2008). Emerging through technological capability: an overview of India's technological trajectory. Working Paper, No. 227, Indian Council for Research on International Economic Relations (ICRIER), 1-20, New Delhi.

Renko, M., Carsrud, A., & Brännback, M. (2009). The effect of a market orientation, entrepreneurial orientation, and technological capability on innovativeness: A study of young biotechnology ventures in the United States and in Scandinavia. Journal of Small Business Management, 47(3), 331-369. DOI: https://doi.org/10.1111/j.1540-627X.2009.00274.x

Ringle, C. M., & Sarstedt, M. (2016). Gain more insight from your PLS-SEM results: The importance-performance map analysis. Industrial management & data systems, 116(9), 1865-1886. DOI: https://doi.org/10.1108/IMDS-10-2015-0449

Rowley, J., & Hartley, R. (2017). Organizing knowledge: an introduction to managing access to information. Routledge. DOI: https://doi.org/10.4324/9781315247519

Salisu, Y., & Bakar, L. J. A. (2019). Technological capability, relational capability and firms’ performance. Revista de Gestão. 27(1), 79-99. DOI: https://doi.org/10.1108/REGE-03-2019-0040

Shaikh, A. A. (2013). Mobile banking adoption issues in Pakistan and challenges ahead. Journal of the Institute of Bankers Pakistan, 80(3), 12-15.

Shaikh, A. A., & Karjaluoto, H. (2015). Mobile banking adoption: A literature review. Telematics and informatics, 32(1), 129-142. DOI: https://doi.org/10.1016/j.tele.2014.05.003

Sirmon, D. G., Hitt, M. A., & Ireland, R. D. (2007). Managing firm resources in dynamic environments to create value: Looking inside the black box. Academy of management review, 32(1), 273-292. DOI: https://doi.org/10.5465/amr.2007.23466005

Sohail, M. S., & Shanmugham, B. (2003). E-banking and customer preferences in Malaysia: An empirical investigation. Information sciences, 150(3-4), 207-217. DOI: https://doi.org/10.1016/S0020-0255(02)00378-X

Son, B.-G., Kim, H., Hur, D., & Subramanian, N. (2021). The dark side of supply chain digitalisation: supplier-perceived digital capability asymmetry, buyer opportunism and governance. International Journal of Operations & Production Management, 41(7), 1220-1247. DOI: https://doi.org/10.1108/IJOPM-10-2020-0711

Sousa-Zomer, T. T., Neely, A., & Martinez, V. (2020). Digital transforming capability and performance: a microfoundational perspective. International Journal of Operations & Production Management, 40(7/8), 1095-1128. DOI: https://doi.org/10.1108/IJOPM-06-2019-0444

Van Noort, G., Voorveld, H. A., & Van Reijmersdal, E. A. (2012). Interactivity in brand web sites: cognitive, affective, and behavioral responses explained by consumers' online flow experience. Journal of Interactive Marketing, 26(4), 223-234. DOI: https://doi.org/10.1016/j.intmar.2011.11.002

Waheed, A., Miao, X., Waheed, S., Ahmad, N., & Majeed, A. (2019). How new HRM practices, organizational innovation, and innovative climate affect the innovation performance in the IT industry: A moderated-mediation analysis. Sustainability, 11(3), 1-21. DOI: https://doi.org/10.3390/su11030621

Waldrop, M. M. (2016). More than moore. Nature, 530(7589), 144-148. DOI: https://doi.org/10.1038/530144a

Wijekoon, A., Salunke, S., & Athaide, G. A. (2021). Customer heterogeneity and innovation-based competitive strategy: A review, synthesis, and research agenda. Journal of Product Innovation Management, 38(3), 315-333. DOI: https://doi.org/10.1111/jpim.12576

Xie, X., Wang, L., & Zeng, S. (2018). Inter-organizational knowledge acquisition and firms' radical innovation: A moderated mediation analysis. Journal of Business Research, 90, 295-306. DOI: https://doi.org/10.1016/j.jbusres.2018.04.038

Yasa, N. N. K., Ekawati, N. W., & Rahmayanti, P. L. D. (2019). The Role of Digital Innovation in Mediating Digital Capability on Business Performance. European Journal of Management and Marketing Studies, 4(2), 111-128. doi: 10.5281/zenodo.3483780

Zagzebski, L. (2017). What is knowledge?. The Blackwell guide to epistemology, 92-116, Blackwell Publishing, Malden, USA. DOI: https://doi.org/10.1002/9781405164863.ch3

Zhe, B. O. M., & Hamid, N. A. (2021). The Impact of Digital Technology, Digital Capability and Digital Innovation on Small Business Performance. Research in Management of Technology and Business, 2(1), 499-509.

Zhong, K., Wang, F., & Zhou, L. (2017). Deferred revenue changes as a leading indicator for future financial performance: Evidence from China. Asian Review of Accounting, 25(4), 549-568. DOI: https://doi.org/10.1108/ARA-11-2015-0118

_______________________________

*Autor de correspondencia. Email: zadiguzel@medipol.edu.tr

Fecha de envío: 11/11/2021. Fecha de aceptación: 16/05/2022.